Planning to buy a house in 2022 and wondering where to start?

The property market has been a hive of activity in 2021. As a result of the stamp duty holiday and the race for more space, both internally and externally, sales have sky-rocketed and house prices have soared. It has left some would-be buyers feeling defeated and wondering whether they should forget about their plans to move until the Spring, but now is not the time to give up on your home-moving dreams.

Christmas is no longer the sleepy period when little happens - it is a key time in the sales calendar, with Rightmove and Zoopla reporting that Boxing Day is one of the busiest days of the year. Moreover, the Bank of England has raised the base rate from 0.1% to 0.25%, with further interest rate increases forecast, so now is the time to act.

Here’s our top tips for those looking to find their next home in 2022.

Prepare before looking

Every vendor wants a super-buyer: those who have sold their property, are renting, have cash in the bank or their mortgage agreed, as well as having their solicitor ready to go. Having this ready will put you in a good position.

Get your finances in order

If you spoke to a mortgage broker a few months ago, book an appointment to speak to them again because deals and requirements change on a regular basis. It’s also predicted that interest rates will rise further in 2022, so it’s important to act as soon as possible to secure a good deal.

Before putting an offer on a home, it’s a good idea to get a mortgage-in-principle. This is a confirmation stating how much your lender is prepared to lend you to buy a property and shows sellers that you are a serious buyer with the necessary finances to buy their property and helps speed up the buying process.

Our in-branch advisers, working with Mortgage Advice Bureau, have access to over 12,000 different mortgages from 90+ lenders, meaning they’re ideally placed to help you find a mortgage most suited to your needs and circumstances, whilst ensuring you're not paying more than you need to. Book an appointment today.

Have a solicitor ready

Make sure you have a good local solicitor on hand; choosing someone who knows the area and knows the idiosyncrasies of the local market will help to reduce the number of enquiries raised and generally speed up the process. We recommend a reputable and long-standing local firm of solicitors who can provide a quote for conveyancing.

Know your budget

Research home prices ahead of time

Some buyers will embark on a home search before looking at what they can afford. A better way is to first work out where you can afford to look, before viewing homes. Otherwise, you might fall in love with a home or area that you find you can't afford.

Work on boosting your credit score

The higher your credit score is, the more likely you'll be to get approved not only for a mortgage, but also for a more favourable interest rate. Read our blog on how you can boost your credit score in a number of ways.

Be flexible

Be ready to compromise

Buyers often start with a preconceived idea of where they want to live and what kind of home they want to live in, but if something doesn’t turn up in the first two to three months then think about what you might be able to compromise on and start to look slightly outside of your original plans.

Exchange early

Buyers who can offer complete flexibility are in a strong position, such as those who can offer a swift exchange of contracts and then be flexible on completion, if needed, for the seller to find somewhere to buy.

If you’re renting, make sure your tenancy agreement is on a month-by-month rolling contract if possible, so it doesn’t come to an end before you can move into a property.

Make the most of viewings

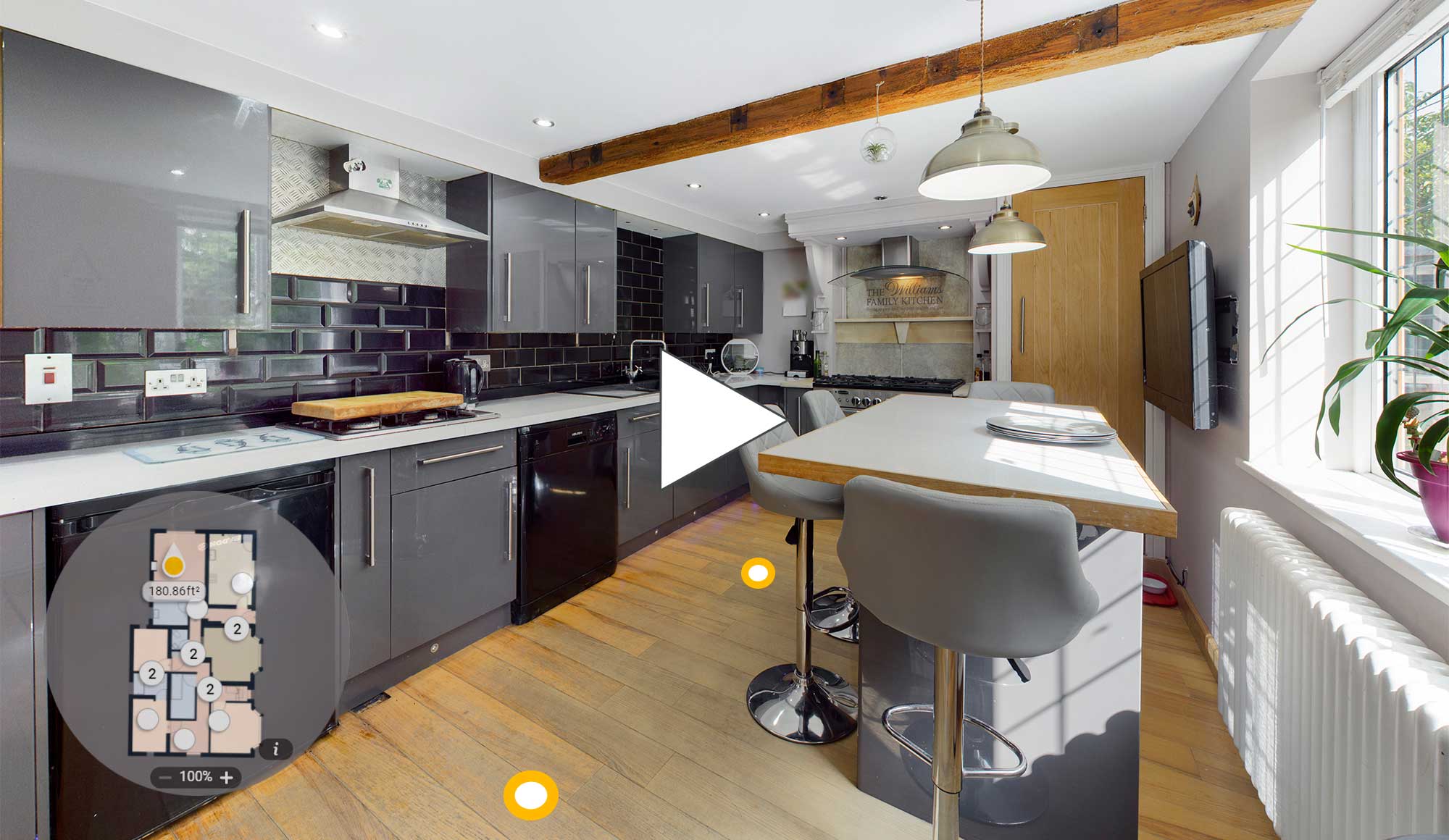

Our interactive virtual tours allow you to ‘walk-through’ homes before viewing them in person, meaning you can create a shortlist and discount any that aren’t for you, before booking appointments to view them in-person. This will mean you’re only spending time viewing properties in-person that you’re actually interested in buying.

What’s more, with our virtual tour system, our experienced team can “accompany” you on a virtual viewing of a property via video chat to answer any queries, there and then.

Don’t wait until Spring

There is no guarantee that there will be a rush of new homes to the market in the Spring — or rather, there might be, but there will be lots of new buyers too. It’s likely that there will be more new buyers than sellers, and competition for each home will therefore be fierce.

Once you’ve got your finances in place, and know your budget, start your search today. Find out what we currently have for sale in Gloucestershire and Worcestershire.